View Procedure

| Procedure Name | Temporal Exports for Commercial Use | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Description |

Required Documents

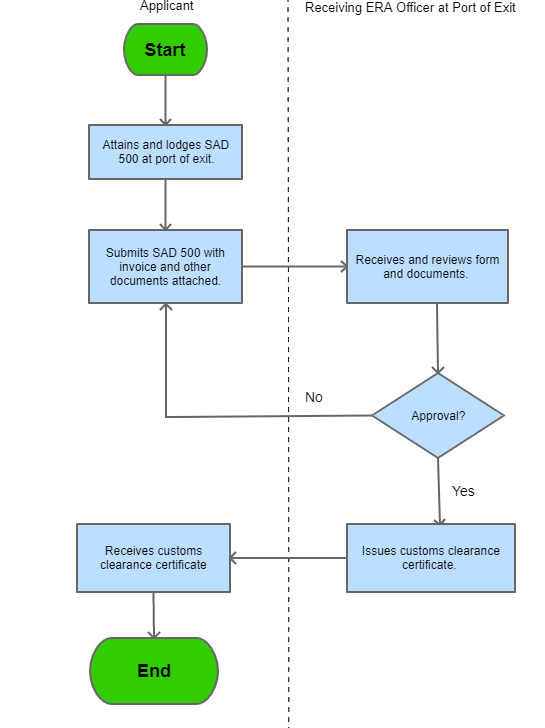

Process Steps

| |||||||||||||||||||||||||||||||||

| Category | Export |

| Title | Description | Created Date | Updated Date | Issued By |  |

|---|---|---|---|---|---|

| No results found. | |||||

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|

| Temporal Exports for Commercial Use | General | Temporary exportation of goods means the Customs procedure under which goods are in free circulation in a Customs territory and may be temporarily exported. An exporter is expected to have an import permit. | Temporal exports for commercial use is when assets are shipped for repairs and maintenance, service, outward processing, exchange, exhibition, hiring / leasing as well as for purposes of storage in approved storage in other countries and then re-imported with total or partial exemption from import duties and taxes or alternatively be permanently exported. | The Customs and Excise Act, 1971 | 09-09-9999 | Good |