View Procedure

| Procedure Name | General Customs Duty Rebates |

|---|

| Description |

|

Category

|

Certificate

|

|

Responsible Agency

|

Address: International Trade Department

Ministry of Commerce, Industry and Trade

Gwamile street

(Between the DPMs office and Eswatini Bank)

Mbabane, Eswatini

Phone: (+268) 2404 1808

Email: bethusilevi@hotmail.com

sarahndzinisa@yahoo.co.uk/bonasa2015@gmail.com

muntualmeida@gmail.com

sandiletitusmlambo@rocketmail.com

khetsiwekd@gmail.com

portiakd@hotmail.com

|

|

Legal base of the Procedure

|

Customs and Excise Act, 1971

|

|

Fee

|

Free of charge

|

Required Documents

|

No.

|

Type of information

|

Note |

| 1 |

Rebate application letter |

Addressed to the Principal Secretary (Ministry of Commerce, Industry and Trade) |

| 2 |

Letter of donation from donor |

|

| 3 |

Invoice of the value of items |

|

| 4 |

Packing list |

|

| 5 |

Approval letter |

Only for medical supplies (Ministry of Health), GMO (Eswatini Environment Authority), and eductional material (Ministry of Education) |

| 6 |

Import permit |

Only for items that require an import permit |

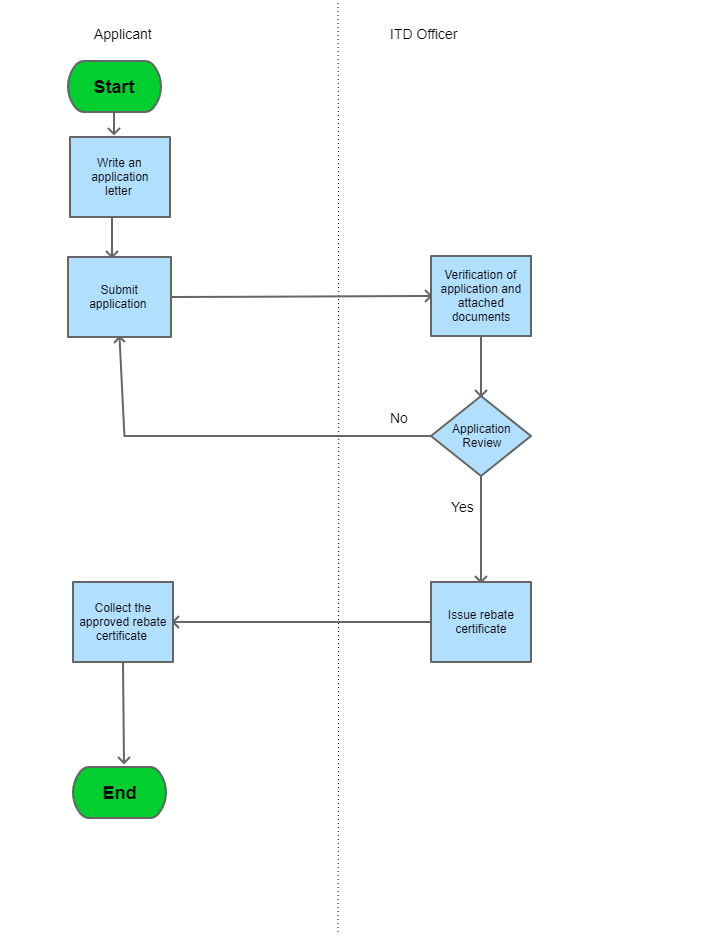

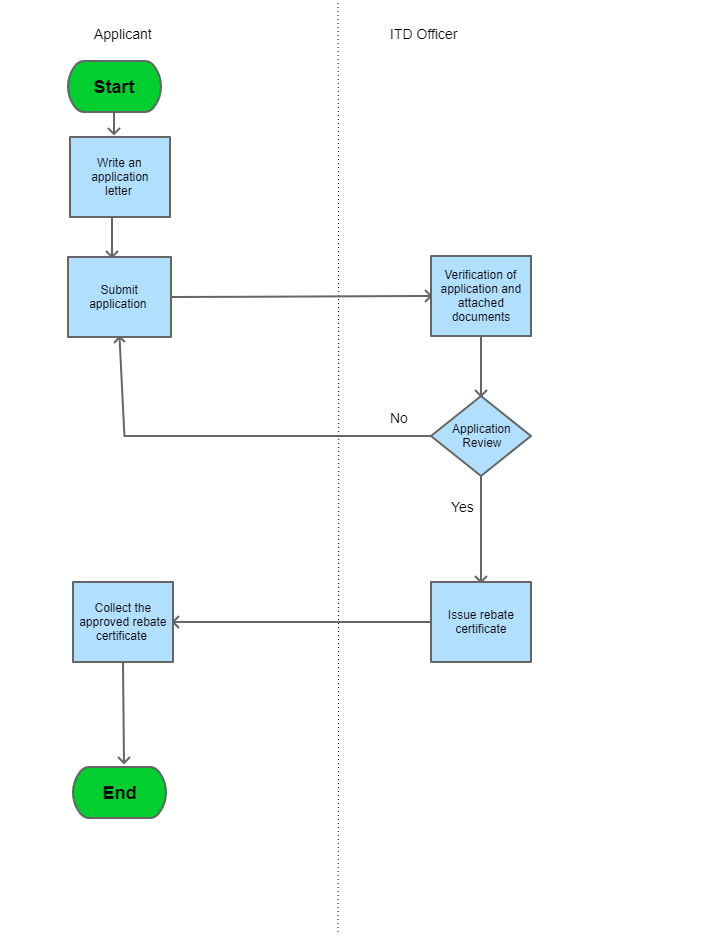

Process Steps

|

Step 1

|

The applicant prepares an application letter to request issue of the rebate certificate. The letter must include reason for application, items description and invoice with value of items (both in ocal and foreign currency). This should also state the donor and the purpose of the donation.

|

|

|

Step 2

|

The applicant submits the letter to the International Trade Department.

|

|

| Step 3 |

The Department processes the application and issues the Rebate Certificate if all requirements are met; or issues a rejection letter with reason if requirements are not met. This may take up to 20 days.

|

|

| Step 4 |

The applicant contacts the Internation Trade Department to collect the approved rebate certificate, signs the register to record collection, and may proceed to Eswatini Revenue Authority for clearance process. |

|

|

|---|

| Category | Import/Export |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| General Customs Duty Rebates | External | | A Rebate is a waiver of customs duties on specified goods under prescribed conditions. Liability will exist until the conditions are fulfilled. Applicable up to a period ending 31 December of each year for a single consignment. | The certificate is obtained from the International Trade Department (ITD) of the Ministry of Commerce, Industry and Trade, and administered by SRA at ports of entry. There are no charges associated with processing and issue of the exemption. The application is made once for a single consignment. On average, the certificate is issued within 20 days on acceptance of the completed rebate letter and attachments for registered organisations, e.g. NGO’s, returning residents etc.

| The Customs and Excise Act, 1971 | 09-09-9999 | Good |

69