View Procedure

| Procedure Name | Import Permit from Ministry of Finance |

|---|

| Description |

|

Category

|

Import Permit

|

|

Responsible Agency

|

Ministry of Finance Building, Mhlambanyatsi

Address: Ministry of Finance Building, Mhlambanyatsi Road, Mbabane, Swaziland

Mbabane, Swaziland

Phone: +268 2404 8145/9

Email: ps@finance.gov.sz

|

|

Legal base of the Procedure

|

Import Control Regulations 1980 ,

Legal Notice No. 182 Of 2020,

Legal Notice No. 183 Of 2020

Legal Notice No. 60 Of 2000

The Customs and Excise Act, 1971

The Sales Tax Act, 1983

The Value Added Tax Act, 2011

|

|

Fee

|

Stamp duty fee of E25 is paid for every E2,000 of the value of the goods

|

Required Documents

|

No.

|

Type of information

|

Note |

|

1

|

Application form - Import Permit for Commodities

|

Application for permit to import controlled commodities |

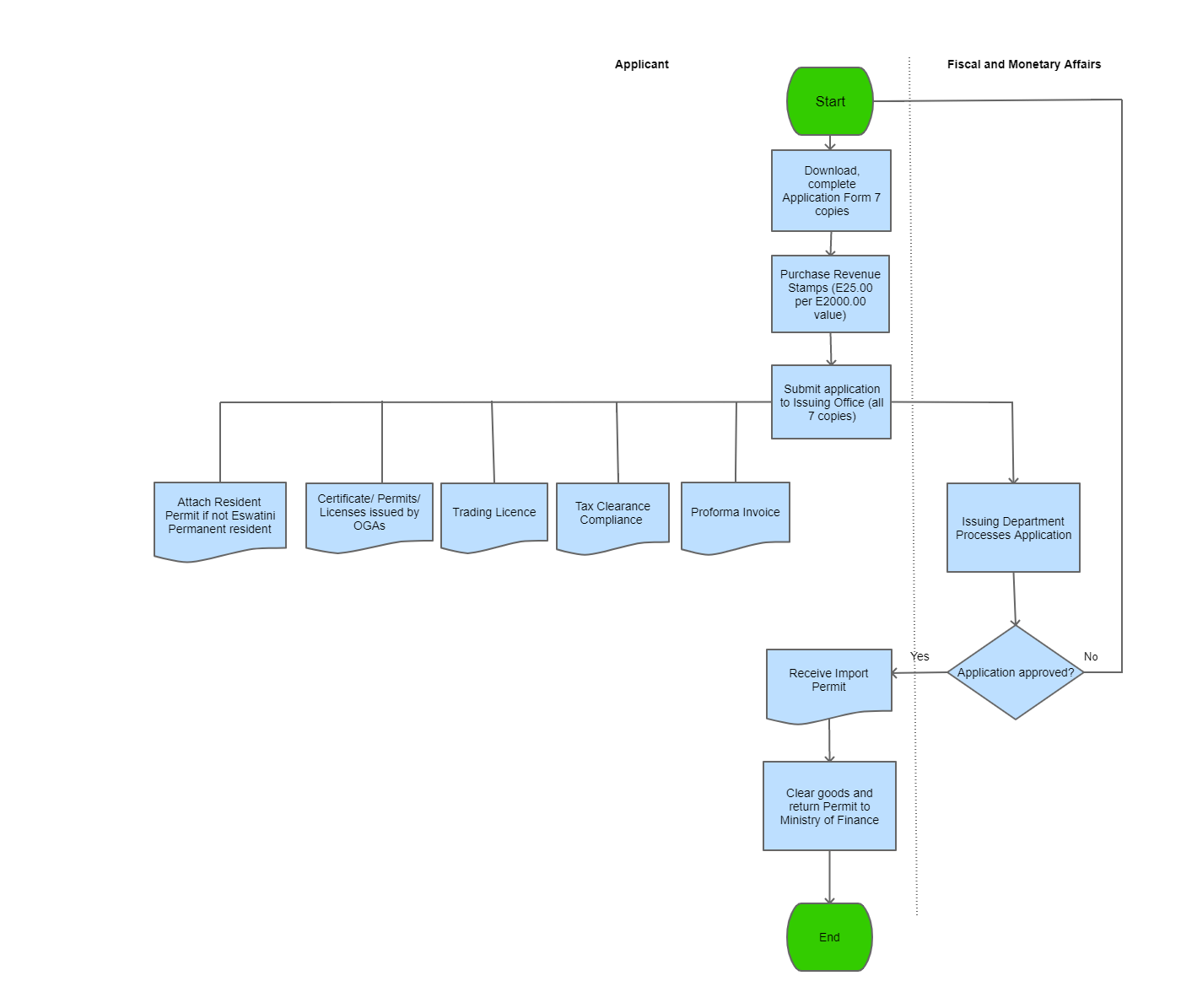

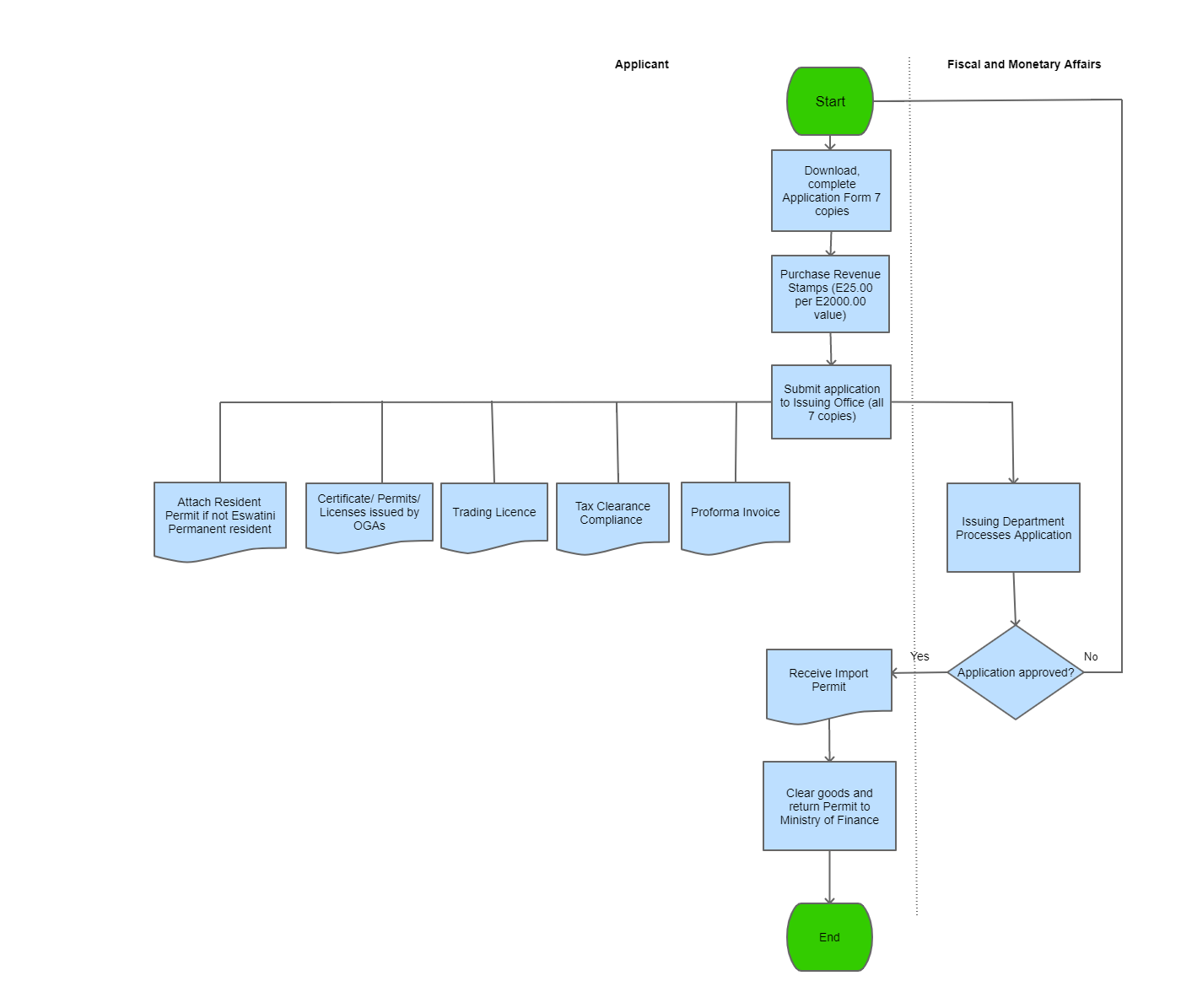

Process Steps

|

Step 1

|

Applicant downloads the application form and gathers all required supporting documents in seven (7) copies

|

|

|

Step 2

|

Applicant should buy Revenue Stamps and attach it to application

|

|

| Step 3 |

Applicant submits the application and supporting documents (all copies) to the Fiscal and Monetary Affairs Department, MOF. |

|

| Step 4 |

The Fiscal and Monetary Affairs Department processes the application, and with all correct documents issues the Import Permit for Commodities applied for. |

|

| Step 5 |

For motor vehicles, applicant rcieves through email the issued permit from MoF

For other commodities, the applicant collects the issued permit and proceeds to import the commodity in accordance with customs formalities and subject to compliance with relevant import requirements

|

| Step 6 |

A copy of the permit and related information are filed for record keeping at Trade Policy Section of MOF.

|

|

|

|---|

| Category | Import |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| Import Permit from Ministry of Finance | Permit Requirement | | Import permits are required for importation of certain goods from outside the Customs Union area. Importers of goods listed below are expected to obtain an import permit from the Ministry prior to importation of the goods in question. (Note: The list of goods is not exhaustive. Items are added and taken off as the government dictates).

1. Used Motor Vehicles

2. Used Earthmoving Equipment

3. Used Clothing

4. Used Tires/ Tire Casings

5. Used Footwear

6. Used Textiles

7. Mineral Fuels

8. Mineral Oils

9. Automotive Parts

10. Arms

11. Drugs

12. Gold and Other Precious Metals

13. Wild Animal Products

14. Agricultural Products (wheat, flour, dairy, maize, rice)

15. Electrical appliances

16. Human Remains

17. Meat/Animals

| The import permit is obtained from the Fiscal and Monetary Affairs Section of the Ministry of Finance, through download and completion of an application form. | Import Control Regulations 1980 | 09-09-9999 | Good |

2