View Procedure

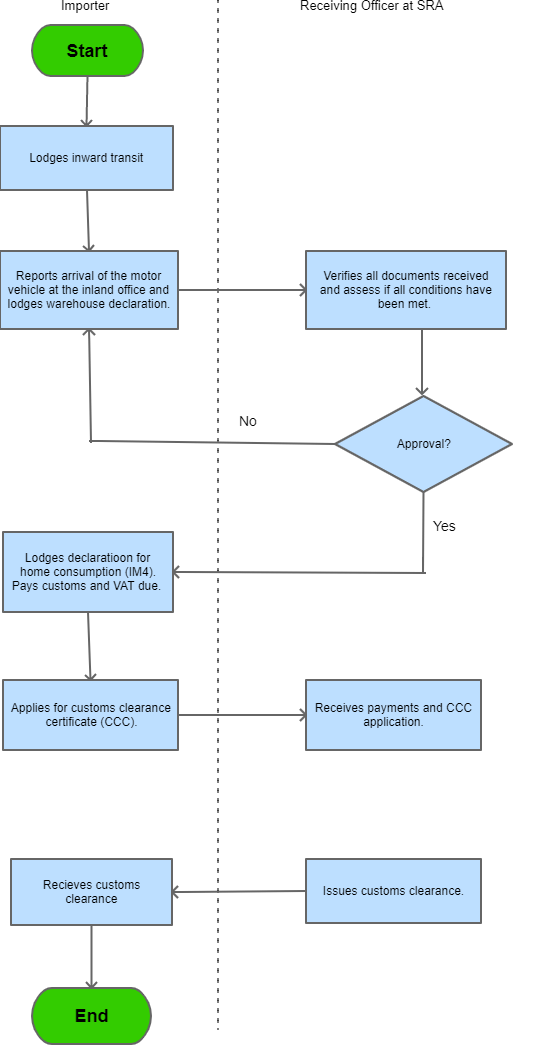

| Procedure Name | Customs Clearance Certification for Motor Vehicles | |||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Description |

Required Documents

Process Steps

| |||||||||||||||||||||||||||||||||||||

| Category | Procedure |

The following form/s are used in this procedure

| Title | Description | Created Date | Updated Date | Issued By |  |

|---|---|---|---|---|---|

| No results found. | |||||

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

|---|---|---|---|---|---|---|---|

| Declaration of good imported or exported | Duty/Tax Payable | Every importer of goods shall, within seven days of the date on which such goods are deemed to have been imported or within such further time as the Commissioner may allow, make due entry of those goods, in the form prescribed, and declare to the truth of such entry. | Trader should fill in a form declaring the good imported or exported by aircraft, overland, post. | The Customs and Excise Act, 1971 | 09-09-9999 | Good | |

| Application for Customs Clearance Certificates | Duty/Tax Payable | After declaring importation, no such goods may be removed from a duty warehouse or appropriated for use by the owner prior to or without the issuing of such certificate, invoice or other document. | Customs Clearance Certificates shall be applied for and issued at the Inland offices at The Plaza, Corporate Place. Mbabane and Manzini Regional Office (MRO), Matsapha. | The Customs and Excise Act, 1971 | 09-09-9999 | Good | |

| Declaration of inward transit for motor vehicles | Duty/Tax Payable | An inward transit declaration shall be made for motor vehicles imported from non-SACU countries and which are covered by a bond. | The transit shall be acquitted by an appropriately framed warehouse declaration (IM7) or an import declaration for home use (IM 4) which is properly linked to the transit declaration (IM 8) in order to enable generation of manifest and acquittal of the transit note (T1) | The Customs and Excise Act, 1971 | 09-09-9999 | Good |